Annual FBO Fuel Sales Survey: 75% of FBOs Report Positive Fuel Sales in 2018

/2019 Industry Forecast: Slow to Moderate Growth Expected

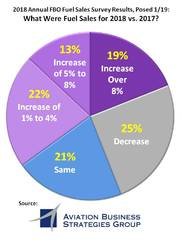

Click to enlarge.Results of our Annual FBO Fuel Sales Survey are in, and we are happy to report that 75 percent of FBOs responding to the survey experienced positive — increased or the same — fuel sales in 2018 compared to 2017.

Click to enlarge.Results of our Annual FBO Fuel Sales Survey are in, and we are happy to report that 75 percent of FBOs responding to the survey experienced positive — increased or the same — fuel sales in 2018 compared to 2017.

This is the third consecutive year we have seen an increase in fuel sales by more than half of FBOs responding.

On the high end, 20 percent of the surveyed FBOs reported increases of more than 8 percent year-over-date. The results are consistent with informal inquiries we made of numerous FBO operators at NBAA-BACE in October.

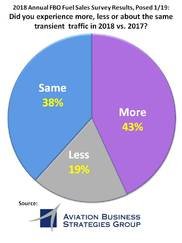

To go along with this upbeat information, survey respondents reported a 43 percent increase in transient ramp traffic last year.

Fuel sales were mostly in synch with aviation business flight activity as reported by ARGUS TRAQPak, which tracks hours flown by the business aircraft fleet.

For most of 2018, monthly business aircraft flight activity increased incrementally year-over-date compared to 2017 with a slight softening in the last quarter. For the year, flight activity rose slightly, registering a 0.9 percent gain over 2017, while flight hours rose 0.7 percent for the same period. Though still in positive territory, both flight activity and hours flown seem to have peaked toward the end of the year.

Click to enlarge.Another area we like to explore with FBO operators is trying to understand the greatest challenges, which resulted in these top five concerns:

Click to enlarge.Another area we like to explore with FBO operators is trying to understand the greatest challenges, which resulted in these top five concerns:

- Employee retention

- Fuel pricing

- Erosion of fuel margins due to contract fuel suppliers

- Lack of flight instructors

- Cost of flying

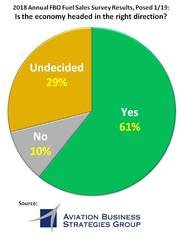

An additional section of the survey gauges FBO operator confidence in the economy. We saw a little softening in this area. Sixty-one percent of respondents agree that the economy is headed in the right direction. This is a slight decrease from the 73 percent recorded last year.

2019 FBO Industry Forecast

Based on the Annual FBO Fuel Sales Survey, interviews with FBO owners and aircraft operators, and analysis of the oil markets and the aviation fuel industry, we put together the following forecast for the FBO industry in 2019:

Operators Bullish on Fuel Sales in 2019

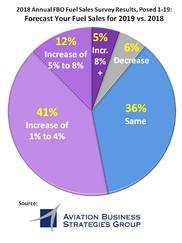

Click to enlarge.As part of the survey, ABSG asked FBO operators to predict fuel sales for 2019 vs. 2018:

Click to enlarge.As part of the survey, ABSG asked FBO operators to predict fuel sales for 2019 vs. 2018:

- 36 percent said they expect to have at least the same fuel sales as in 2018

- 53 percent said they forecast fuel sales increases of 1 percent to 8 percent

- 5 percent expect fuel sales to exceed 8 percent

- Only 6 percent expect fuel sales to decline

Slow to Moderate Industry Growth

On average, we expect moderate 1.5 percent to 2.0 percent growth in FBO business aviation activities, including base customer aircraft movements, transient traffic arrivals and gallons pumped. This rate will closely follow the predictions for the U.S. GDP growth rate for 2019. With slower growth expected in business aircraft flight activity and hours flown, FBO operators should look at every facet of their operation to minimize costs and work more efficiently.

FBO Industry Consolidation

The larger chains have not made substantial moves to expand their FBO networks, and there is little sign of megamergers on the horizon. However, some smaller and emerging chains continue to add FBOs sporadically through the acquisition process.

Oil Prices

Click to enlarge.In the oil field, expect WTI prices to stay relatively low through the first quarter of 2019, hovering between $52 and $58 per barrel. Greater seasonal demand in the second and third quarters should see oil prices rise and level in the $60- to $65-per-barrel range.

Click to enlarge.In the oil field, expect WTI prices to stay relatively low through the first quarter of 2019, hovering between $52 and $58 per barrel. Greater seasonal demand in the second and third quarters should see oil prices rise and level in the $60- to $65-per-barrel range.

Jet A Fuel Prices

Regarding Jet A fuel costs, the current Gulf Coast Platts price is $1.84 per gallon and will follow the price of oil, as in the past. With seasonal adjustments heading into summer, we would anticipate Gulf Coast prices to increase to approximately $2.21 per gallon. FBOs will need to be mindful of what is in their inventory and adjust their fuel margins regularly.

Trend: FBO Selection Based on Safety Standards

Aircraft operators, particularly those flying internationally, will become more selective in choosing FBO service providers in favor of those with a minimum of at least a safety management system (SMS) and/or an IS-BAH registration designation.

Please leave any comments you have about this blog post below. If you have any questions, please give us a call or send us an email: jenticknap@bellsouth.net, 404-867-5518; ronjacksongroup@gmail.com, 972-979-6566.

ABOUT THE BLOGGERS:

John Enticknap has more than 35 years of aviation fueling and FBO services industry experience and is an IS-BAH Accredited auditor. Ron Jackson is co-founder of Aviation Business Strategies Group and president of The Jackson Group, a PR agency specializing in FBO marketing and customer service training. Visit the biography page or absggroup.com for more background.

SUBSCRIBE:

Subscribe to the AC-U-KWIK FBO Connection Newsletter

© 2019 ABSG