Essential Fuel Supplier Agreement Elements: Term of Agreement, Pricing Methodology, and Transportation and Delivery

/Detailing the 10 Essential Elements of a Favorable Fuel Supplier Agreement, Part 1

By John L. Enticknap and Ron R. Jackson, Principals, Aviation Business Strategies Group

In our last blog post, we introduced our new series on the 10 essential elements of a favorable fuel supplier agreement which is one of the six intangibles that can build equity in your FBO.

For this blog post, we'll break down three of the favorable fuel supplier agreement elements and provide insight and tips to help you protect your business while adding intrinsic value.

Before we detail each of these elements, it is important to understand that you should act in your own best interest by first going out for competitive bids to several fuel suppliers. This will give you a better understanding of the parameters set by each fuel supplier and which incentives are available that may help you in your negotiating process.

Term of agreement

In a nutshell, you should protect your enterprise from engaging in an agreement that is excessively long in order to maintain flexibility within an ever changing industry landscape. As you grow your business, and in particular your fuel volume, you can gain leverage by keeping the term of your fuel supplier agreement within a three- to five-year period. You may find that you can obtain a better fuel price by a longer-term agreement, but you may lose the desired flexibility that a shorter term provides.

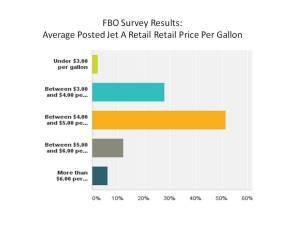

Pricing methodology

Understanding fuel pricing methodology will increase your odds of negotiating a favorable agreement. If your FBO is pumping at least 300,000 to 400,000 gallons per year, you should be able to get a contract that has an index-based pricing formula. That way, you can negotiate the differential fee to be paid to your supplier. The differential is the profit margin that the supplier will be receiving on each fuel purchase by the FBO. Unbundle your pricing structure so you know each cost element. For example:

- Index price

- Differential

- Transportation

- Federal taxes

- State and local taxes

- Flowage fees at the airport

This pricing formula applies to Jet A purchases. Avgas pricing, on the other hand, is determined at the time of purchase.

Transportation and delivery

Don't overlook or downplay this element, for there are savings that you can negotiate. First, you need to know the primary terminal and secondary terminal where your Jet A fuel and Avgas will be picked up by the transportation company. Delivery should favor your FBO schedule, such as at night or during the slow periods during the day. This will optimize time for quality control to be completed efficiently.

Also, obtain proposals from multiple transportation firms. Although they must be approved by your supplier, this can benefit your effort to minimize costs. After all, you, as the FBO owner/operator, are the ultimate customer. You should also determine any extra charges, such as delays in delivery, extra charges for high cost of fuel or other fees. Although extra charges for high cost of fuel are not an issue in today’s market, they have been in the past.

As we work through each of these elements, please keep in mind that there are many factors and nuances that we will not be able to expound on in the framework of a blog. Therefore, we encourage you to attend one of our NATA FBO Success Seminars where we spend additional time and discussion on these important topics as well as others.

About the bloggers:

John Enticknap has more than 35 years of aviation fueling and FBO services industry experience. Ron Jackson is co-founder of Aviation Business Strategies Group and president of The Jackson Group, a PR agency specializing in FBO marketing and customer service training. Visit the biography page or absggroup.com for more background.

Subscribe: